Holistic Risk Management: Self-Care for Healthy Businesses

The term “holistic” is thrown around a lot these days. In the area of wellness, the idea is that to truly be healthy, all parts of your being – your body, mind, and spirit – should focus on practices that maintain health and well-being. Eating wholesome foods. Performing mindfulness techniques. Using supplements as needed. Exercising. Taking time to focus on activities that bring you joy.

Each individual part of the body – and the practices applied – enhances well-being synergistically.

Likewise, when one system is not functioning well, the others can suffer. Think of losing someone close to you – death, divorce, distance. This event can bring mental stress, but it can also manifest as physical pain. Headaches. Body aches. Digestive issues. Tiredness from lack of sleep.

The return on the investment of holistic self-care is, as they say, living the best life. Alternatively, pushing aside self-care can bring the opposite – disease, depression, or even feeling a lack of purpose in life.

Business Should Function the Same Way

Businesses should apply this philosophy of holistic “care” in the form of risk management.

Think of your complete business “being” as:

- Your employees

- Your assets like buildings and equipment

- Your products or services and the methods used to deliver them to clients

- The clients and communities you serve

How you care for these elements rolls up into a culture of high performance, safe best practices, loyal clients, and a sense of purpose within your community.

Holistic Risk Management, Applied

So how do you build a business that applies the holistic risk management philosophy?

It sounds complex. But by working with an expert risk consultant who can help educate your staff, find tools that enhance productivity, and monitor these solutions, you can confidently build a business that operates holistically.

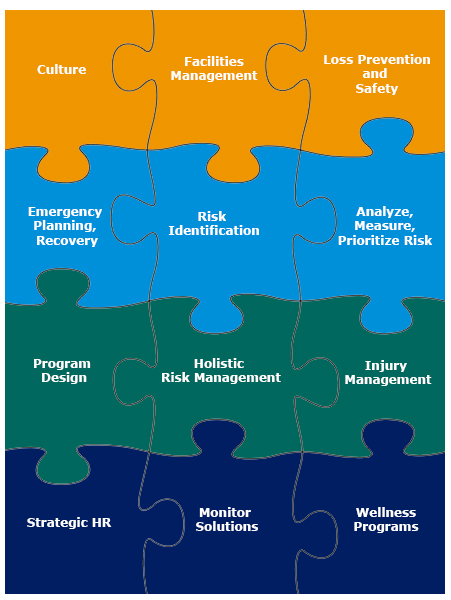

The Holistic Risk Management “Parts”

- Facilities Management: “Keeping shop” doesn’t just provide cleaner facilities. Routine inspection and maintenance of facilities can reduce injuries, enhance worker productivity, reduce the likelihood of larger problems in the future (think of an oil tank leak and the resulting clean-up) and yes – provide a better client experience. Ultimately, these practices result in reducing insurance risk through mitigating property, liability, and workers’ compensation claims.

- Loss Prevention and Compliance: Like above, you must understand state and federal compliance related to your facilities, and what practices your employees should follow to maintain a safe environment.

- Should employees wear specific footwear to minimize slips and falls? Should they wear goggles or safety hats to protect from debris?

- How should heavy equipment be handled, managed, and even stored?

- All these questions come into play, depending on the type of business you operate.

- Emergency Planning/Recovery: We all know bad things can, and will, happen.

- Do you have an emergency response plan in the case of fire, flood, or another disaster?

- What about a cyber hack that impacts your technology systems that slows or halts operations?

- What about an active shooter situation?

- The plan should include protocols if your business is operational during the disaster, or for an event that happens after hours. Each manager should be trained on these risks and how to alert and keep employees safe, how to plan for being non-operational, and even how to help employees with counseling or support depending on the incident.

- Programs and Wellness: Identifying programs that can benefit employees is key to holistic risk management. Benefits programs including worksite benefits can improve job satisfaction, help recruit new employees, and help contain costs by seeking alternative funding arrangements for overall plans, prescriptions, or specific conditions and related treatment. Programs that provide tips for finding the most cost-effective treatment and improve mental health equal happier, healthier, and more engaged employees.

- Injury Management: Businesses should have procedures in place to ensure the work under each job role is documented and completed safely to reduce injuries. But injuries happen. A risk consultant can help with handling workers’ compensation claims and/or return-to-work programs to accommodate workers based on their injuries, and ensuring injured employees work with medical providers to receive the care needed to recover.

- HR Solutions: Risk also includes employee behavior and actions. A proactive approach to HR includes processes for hiring, disciplining, and firing. Managers should be effectively trained to understand and handle harassment claims, and employees should understand how and when to report them. A consultant with on-site attorneys can also help guide you through how to handle tough hiring situations.

- Monitoring: Holistic Risk Management isn’t a one-and-done application. Here’s where the philosophy comes in. Continual monitoring of claims, issues, and incidents can provide critical detail of gaps in managing risk, and how protocols can be amended. Is there a pattern to incidents or claims? This can help prioritize the most pressing issues and help you budget on how to address them – not just in funding, but within a targeted timeframe.

And of course, because we work in insurance…we must ask, do you know how your insurance policies would respond to property, liability, harassment, or medical claims, resulting in reduced revenue and even litigation? Don’t hesitate, reach out and engage the risk and benefits experts at Keystone – conduct a collaborative review of your overall risk management policies and procedures, current programs, and past claims to develop a plan of action – due diligence with a high ROI.

Identify/Analyze Your Risks to Build a Plan

The risk and benefits experts at Keystone perform a two-step process to identify, validate, and analyze your commercial business to build a plan with coverage, process, and education that can help contain costs and reduce overall risk. Contact us today to get started.